The Hawaiʻi

State Constitutional Convention Clearinghouse

Information Related to Hawaiʻi's November 6, 2018 State Constitutional Convention Referendum

Hawaii has two constitutional referendums on the Nov. 6, 2018 ballot. This page provides information on the first one, which allows the state to tax property (a government power previously reserved for the counties). Although the subjects of the ballot items are highly different, the politics of the two constitution-related referendums are likely to be closely interrelated.

The Text of the Property Tax Amendment

Description

Proposes amendments to the Constitution of the State of Hawaii to advance the State’s goal of providing a quality education for the children of Hawaii by authorizing the legislature to establish, as provided by law, a surcharge on residential investment property and visitor accommodations.

Text

PROPOSING AMENDMENTS TO ARTICLES VIII AND X OF THE CONSTITUTION OF THE STATE OF HAWAII TO AUTHORIZE THE LEGISLATURE TO ESTABLISH A SURCHARGE TO INCREASE FUNDING FOR PUBLIC EDUCATION. BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF HAWAII:

SECTION 1. The legislature finds that article X, section 1, of the Constitution of the State of Hawaii requires the State to provide a system of public education. Compared to other states, Hawaii is unique because the State, rather than a county or local level jurisdiction, is responsible for public education. As a result, funding for public education in Hawaii is primarily sourced from the general fund of the State. The legislature further finds that public education in Hawaii is not adequately funded. According to an analysis of real property tax in Hawaii performed by the department of business, economic development, and tourism in 2017, Hawaii’s education expenditures, as a share of combined state and local government expenditures, is 27.3 per cent and ranks lowest in the nation. At $12,855 per child, Hawaii trails mainland school districts of similar size when adjusting for cost of living. Lagging state education expenditures drive Hawaii families to compete for private school enrollment, leaving Hawaii with one of the highest rates of private school enrollment in the nation, according to the United States Census Bureau. The legislature additionally finds that the United States Department of Education currently considers over seventy per cent of Hawaii’s public schools to be Title I schools. A majority of public school students are now considered “high-needs” students, meaning that the student qualifies for free or reduced price lunch, is an English language learner, or is a special education student. Hawaii public school facilities average sixty-one years in age, with the average school building over forty-four years old and fifty-three buildings being over one hundred years in age. Hawaii ranks fifty-first out of fifty states and the District of Columbia in starting and median teacher salaries adjusted for cost of living, according to a 2016 study performed by WalletHub.com. The legislature also finds that chronic underfunding of public schools undermines the State’s goal of providing a quality education to all of Hawaii’s children. Insufficient education funding results in delayed repairs to school facilities; overheated classrooms, higher class sizes, a lack of adequate classroom supplies, elimination of arts and career and technical education courses, budget cuts for special education and English language learner programs, and an increasing number of vacant teacher positions statewide. It is necessary to develop a new means of funding Hawaii’s public education system to ensure that the State will be able to prepare children to meet the social and economic demands of the twenty-first century. The purpose of this Act is to propose amendments to the Constitution of the State of Hawaii to advance the State’s goal of providing a quality education for the children of Hawaii by authorizing the legislature to establish a surcharge on residential investment property and visitor accommodations.

SECTION 2. Article VIII, section 3, of the Constitution of the State of Hawaii is amended to read as follows: “TAXATION AND FINANCE Section 3. The taxing power shall be reserved to the State, except so much thereof as may be delegated by the legislature to the political subdivisions, and except that all functions, powers and duties relating to the taxation of real property shall be exercised exclusively by the counties, with the exception of the county of Kalawao[.]; provided that the legislature shall not be prohibited from establishing a surcharge on residential investment property pursuant to Article X, Section 1. The legislature shall have the power to apportion state revenues among the several political subdivisions.”

SECTION 3. Article X, section 1, of the Constitution of the State of Hawaii is amended to read as follows: “PUBLIC EDUCATION Section 1. The State shall provide for the establishment, support and control of a statewide system of public schools free from sectarian control, a state university, public libraries and such other educational institutions as may be deemed desirable, including physical facilities therefor. There shall be no discrimination in public educational institutions because of race, religion, sex or ancestry; nor shall public funds be appropriated for the support or benefit of any sectarian or nonsectarian private educational institution, except that proceeds of special purpose revenue bonds authorized or issued under section 12 of Article VII may be appropriated to finance or assist:

- Not-for-profit corporations that provide early childhood education and care facilities serving the general public; and

- Not-for-profit private nonsectarian and sectarian elementary schools, secondary schools, colleges and universities.

The legislature may establish a surcharge on residential investment property valued at one million dollars or greater and visitor accommodations, as provided by law, to fund a quality public education for all of Hawaii’s children, including but not limited to the recruitment and retention of teachers, public preschools, lower class sizes, special education programming, career and technical education, art, music, Hawaiian studies, Hawaiian language instruction, and afterschool programs; provided that for the purposes of this section:

- “Residential investment property” means and includes all land and appurtenances thereof and the buildings, structures, fences, and improvements erected on or affixed to the same, and any fixture that is erected on or affixed to such land, buildings, structures, fences, and improvements, including all machinery and other mechanical or other allied equipment and the foundations thereof, and including apartments and condominiums, that is dedicated for residential use and for which the owner does not qualify for a homeowner’s exemption.

- “Visitor accommodations” means and includes any room, apartment, suite, single family dwelling, or time share unit furnished for less than one hundred eighty consecutive days for each letting in a hotel, apartment hotel, motel, condominium property regime, apartment, time share vacation property, cooperative apartment, dwelling unit, or rooming house that provides living quarters, sleeping, or housekeeping accommodations, or any other place in which lodgings are furnished to transients.“

SECTION 4. The question to be printed on the ballot shall be as follows: “Shall the legislature fund a quality public education for all of Hawaii’s children, including the retention of teachers, public preschools, lower class sizes, special education programming, career and technical education, art, music, Hawaiian studies, Hawaiian language instruction, and afterschool programs, by establishing a surcharge on visitor accommodations and residential investment property valued at one million dollars or greater, excluding a homeowner’s primary residence, as provided by law?” SECTION 5. Constitutional material to be repealed is bracketed and stricken. New constitutional material is underscored. SECTION 6. This amendment shall take effect upon compliance with article XVII, section 3, of the Constitution of the State of Hawaii.

Sources

SB2922, Hawaii State Legislature. Notice of Proposed Constitutional Amendments to the Constitution of the State of Hawaii, Honolulu Star-Advertiser, October 7, 2018. Paid advertisement by the State of Hawaii.

Vote Yes

Iwamoto, Kim Coco, This Landlord-Investor Says Vote ‘Yes’ On ConAm For Schools, Civil Beat, October 18, 2018.

Hooser, Gary, Should voters OK education amendment? Yes, Honolulu Star-Advertiser, October 17, 2018.

Okamura, Jonathan Y.. Vote yes for ConAm to increase funding for public education, Honolulu Star-Advertiser, October 16, 2018.

Blair, Chad, Civil Beat Poll: Hawaii Voters Oppose ConAm On Property Taxes, Civil Beat, October 16, 2018.

Boyd, Lawrence W., Amendment necessary to support public schools properly, Honolulu Star-Advertiser, October 4, 2018.

Isbell, Alan, Legal defeat underscores hypocrisy of constitutional amendment challenge, Honolulu Star-Advertiser, September 20, 2018.

Rosenlee, Corey, Tax would help kids and deter rich outside investors, Honolulu Star-Advertiser, September 16, 2018.

Hughey, Justin, Constitutional change can help create ‘kingdom of learning’, Honolulu Star-Advertiser, May 22, 2018. Letter to editor.

Isbell, Alan, Proposed constitutional amendment could be an elixir for public schools, Maui News, May 24, 2018. The author is president of the Hawaii State Teachers Association, Maui Chapter.

Rosenlee, Corey, Rich real-estate speculators can afford to help educate keiki, Honolulu Star-Advertiser, May 8, 2018. The author is is president of the Hawaii State Teachers Association.

Vote No

ConAm proposal poorly conceived, Honolulu Star-Advertiser, October 21, 2018.

King, Kelly Takaya, Why I’m Voting ‘No’ On The Proposed New Tax, Civil Beat, October 12, 2018.

Perez, Joseph, The Legislature already has plenty of ways to raise more money for public education, Honolulu Star-Advertiser, September 20, 2018.

James, Choon, Not all ‘investment real property’ owners are wealthy, Honolulu Star-Advertiser, September 16, 2018. Borreca, Richard, Passive-aggressive ‘school tax’ proposal could turn out more aggressive than it seems, Honolulu Star-Advertiser, September 16, 2018.

L’Heureux, Ray, and Randall Roth, A proposed constitutional change aims to let the state tax investment property to fund public education, Honolulu Star-Advertiser, September 16, 2018.

Shapiro, David, Be honest about schools tax before it goes on ballot, Honolulu Star-Advertiser, September 2, 2018. Curtis, Mike, Amendment won’t lock in school funds, Honolulu Star-Advertiser, May 27, 2018. Letter to editor.

Yamachika, Tom, Letting the Genie Out Of The Bottle…For Our Keiki?, Hawaii Reporter, May 7, 2018.

Shapiro, David, Amendment for education would raid county coffers, Honolulu Star-Advertiser, April 22, 2018.

Other

Donnelly, Christine, No guarantees for renter in property tax proposal, Honolulu Star-Advertiser, June 27, 2018.

Editorial: Let public decide on tax for schools, Honolulu Star-Advertiser, April 6, 2018.

News

Lee, Suevon, With ConAm Invalidated, Supporters And Opponents Ponder Next Moves, Civil Beat, October 23, 2018.

Cocke, Sophie, Hawaii Supreme Court invalidates ConAm question, Honolulu Star-Advertiser, October 19, 2018.

Yerton, Stewart, Court Strikes Down Education Tax Ballot Measure, Civil Beat, October 19, 2018.

Cocke, Sophie, Justices expected to quickly rule on ballot question, Honolulu Star-Advertiser, October 19, 2018.

Constitutional amendment: What you need to know about a surcharge for education, KHON2, October 16, 2018

Blair, Chad, Ad Watch: Four Hawaii Govs Team Up To Defeat ConAm, Civil Beat, October 15, 2018.

Blair, Chad, Ad Watch: TV Spots Attack Constitutional Amendment For School Taxes, Civil Beat, October 5, 2018. Includes links to no campaign ads. Cocke, Sophie, Hawaii Supreme Court to hear challenge to ballot question, Honolulu Star-Advertiser, October 5, 2018.

Cocke, Sophie, Group gives $600K to fight tax measure, Honolulu Star-Advertiser, October 3, 2018.

Shapiro, David, Fuzzy thinking and fights fail to rouse bored voters, Honolulu Star-Advertiser, September 30, 2018.

Lee, Suevon, This Ballot Measure Is Sparking Intense Debate Over Hawaii’s Schools, Civil Beat, September 24, 2018. The Tax Foundation of Hawaii’s Sept. 26, 2018 amicus brief to the Supreme Court of Hawaii can be found here. Editorial: Brace for constitutional amendment campaigns, Honolulu Star-Advertiser, September 16, 2018.

Cocke, Sophie, Teachers’ proposal would require hefty hike in property taxes, Honolulu Star-Advertiser, September 18, 2018. Brace for constitutional amendment campaigns, Honolulu Star-Advertiser, September 17, 2018.

Freudenthal, Bethany, Opposition rises to tax proposal, The Garden Island, September 14, 2018.

Cocke, Sophie, PACs form to sway voters on school tax ballot issue, Honolulu Star-Advertiser, September 13, 2018. Kauai Chamber opposes tax amendment, West Hawaii Today, September 6, 2018.

Cocke, Sophie, Counties oppose state property tax for public schools, Honolulu Star-Advertiser, August 30, 2018.

Yoshioka, Wayne, HSTA Weighs-In on Constitutional Amendment to Help Fund Public Education, Hawai`i Public Radio, August 15, 2018.

Yoshioka, Wayne, Nov. 6th Constitutional Amendment Question: Investment Property Surcharge for Education?, Hawai`i Public Radio, August 14, 2018.

TV and Radio Interviews

Estrellon, April, Pod Squad: Teachers Union Leader Makes Case For ConAm, Civil Beat, October 1, 2018.

Support for Public Education or Misguided Public Policy, ThinkTech Hawaii, September 10, 2018. Moderator: former Governor Waihee. Guest: Stanley Lau, chair of the Affordable Coalition PAC.

Campaign Finance

For up to date information, go to State of Hawaii Campaign Spending Information, Ballot Issue Committees.

Yes

HSTA for Schools Our Keiki Deserve PAC. Organizational Report / Disclosure Reports (Reg. 4/30/18). Chair: Wilbert Holck. Key vendors:

1) Hamburger Strategies, a national graphic design firm.

2) Anzalone Liszt Grove Research, an Alabama-based firm that does political consulting, including public opinion research, for Democrats. Its clients include former President Barack Obama and Hillary Clinton for President, and it boasts huge success:

“In addition to our success electing candidates, we also boast the best win-loss rate on ballot initiatives in the country, racking up 92 wins and 10 losses. We have provided message guidance that helped lead to major victories on marriage equality, access to contraception, paid-sick day legislation, protecting our environment and much more.

As pollsters, we’re committed to going beyond simply providing numbers. While we’re proud of our ability to collect good data, we believe polling is of little use unless it is paired with clear, actionable strategic advice. We believe in being an active part of the consultant team to ensure the strategic recommendations derived from our research are well executed, disciplined, and exceed the expectations of our clients.” From its website, accessed Sept. 13, 2018.

On its website, it also quotes the Washington Post’s Chris Cillizza saying it was“The best pollster you’ve never heard of.” But J.H. Snider wasn’t able to track this down from the Washington Post. See Johnson, Dennis, Democracy for Hire: A History of American Political Consulting, Oxford University Press, 2017, and Chris Cillizza, Winners and Losers: Of Mountaineers and Magnolias, Washington Post Blog, May 14, 2008.

No

Affordable Hawaii Coalition PAC. Organizational Report / Disclosure Reports (Reg. 7/26/18). PAC Chair: Stanley Lau. No vendors/expenditures are listed on its preliminary report. Watumull Properties Corp PAC. Organizational Report / Disclosure Reports (Reg. 8/28/18)

Grassroots Advocacy

HSTA

Parents, community volunteers and teachers canvass for school funding amendment, HSTA News, October 6, 2018. Notable quote: “Con Am supporters will be outspent by the wealthy business interests who are on the other side…. In this campaign, we know that there are going to be very wealthy people who are going to misinform voters and try to scare people saying it’s going after renters, it’s going after mom and pop stores. And that’s just being deceptive and not telling the truth,’ said HSTA President Corey Rosenlee.”

Parent and children’s groups back constitutional amendment, HSTA News, October 6, 2018.

Lawsuit Over Ballot Wording

Cocke, Sophie, Hawaii Supreme Court invalidates ConAm question, Honolulu Star-Advertiser, October 19, 2018.

Yerton, Stewart, Court Strikes Down Education Tax Ballot Measure, Civil Beat, October 19, 2018.

Yerton, Stuart, Supreme Court Hears Challenge To ConAm Ballot Measure But Defers Ruling, Civil Beat, October 18, 2018.

Cocke, Sophie, Hawaii Supreme Court to hear challenge to ballot question, Honolulu Star-Advertiser, October 5, 2018. Clearinghouse of legal documents maintained by The Tax Foundation of Hawaii. Includes pro and con legal documents.

Lee, Suevon, Judge: Property Tax Measure For Schools Can Stay On Ballot, Civil Beat, September 7, 2018.

Cocke, Sophie, Judge refuses to block November ballot question, Honolulu Star-Advertiser, September 7, 2018.

Editorial, Do The School Tax Ballot Question Right Or Don’t Do It At All, Civil Beat, September 7, 2018.

Cocke, Sophie, Judge to hear challenge to property tax ballot, Honolulu Star-Advertiser, September 6, 2018. Daranciang, Nelson, Investment tax wording on ballot spurs suit, Honolulu Star-Advertiser, August 29, 2018.

Yerton, Stuart, Honolulu Lawsuit Aims To Stop Proposed Ballot Measure On Education Funding, Civil Beat, August 27, 2018.

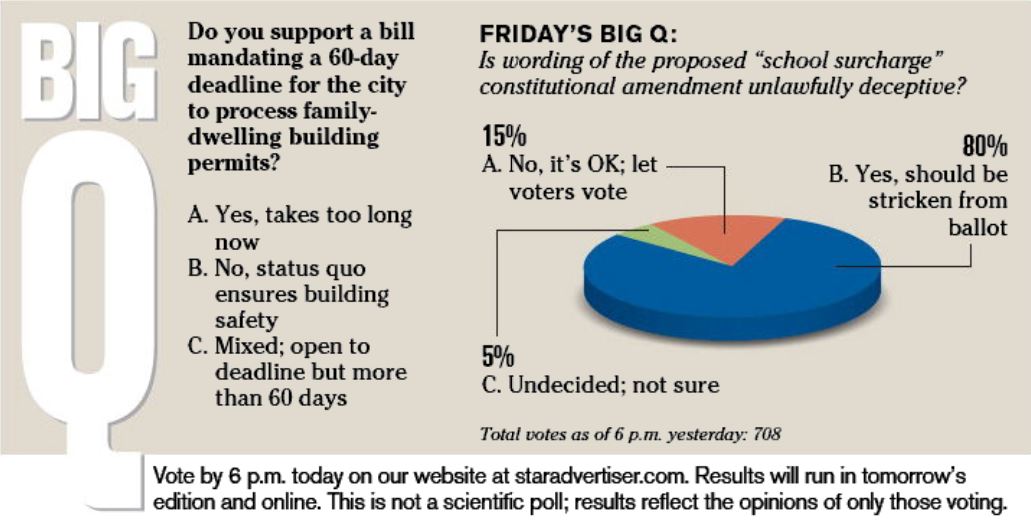

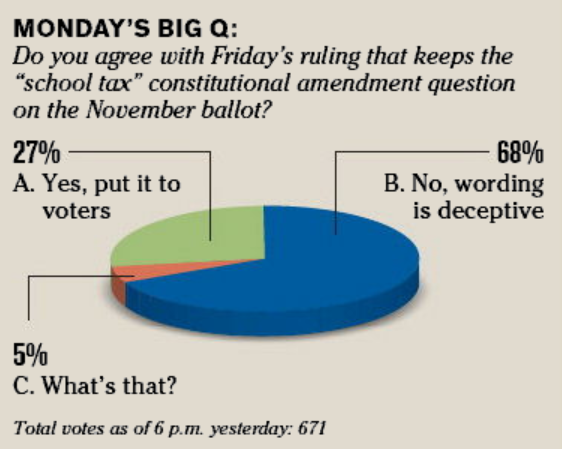

Poll

Is wording of the proposed “school surcharge” constitutional amendment unlawfully deceptive?, Honolulu Star-Advertiser, October 19, 2018.

Do you agree with Friday’s ruling that keeps the “school tax” constitutional amendment question on the November ballot?, Honolulu Star-Advertiser, September 11, 2018.

Recent History Of Hawaii Constitutional Amendment Referendums

From 2008 to 2017, Hawaii held 25 referendums. Of these, 14 passed and 11 failed. See 2018 Hawaii Ballot Measures, Vote Smart. Accessed 29 August 2018.